The Micro Small & Medium Enterprises (MSMEs) play a critical role in the economy with the sector employing an estimated 14.9 million Kenyans and contributing to 34% of the country's Gross Domestic Product (GDP). However, despite this enormous contribution to the economy, the MSMEs face many challenges majorly being access to affordable credit. Furthermore, the Covid-19 pandemic added to these challenges hence affecting cash flow, creating losses and disrupted operations.

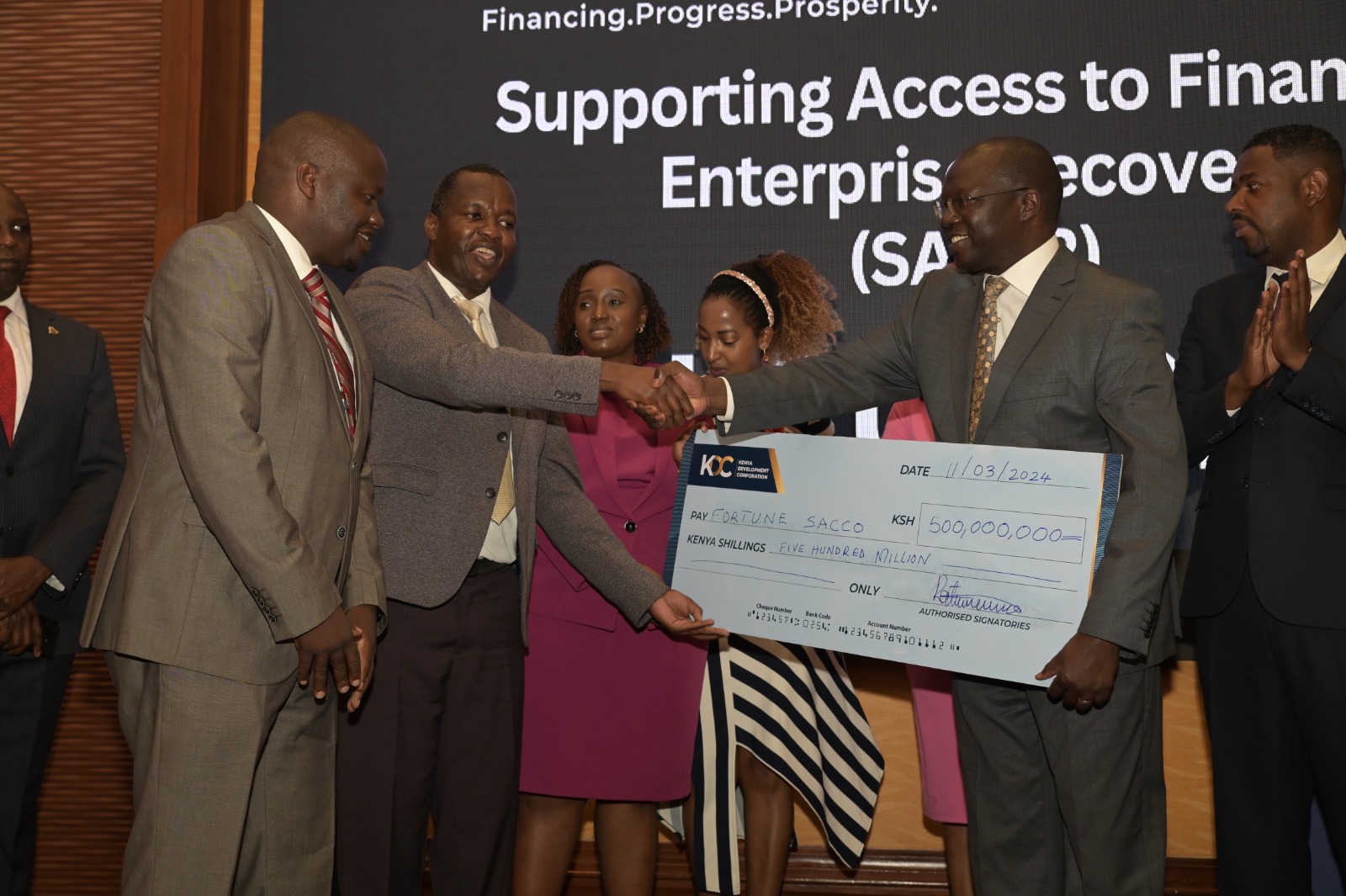

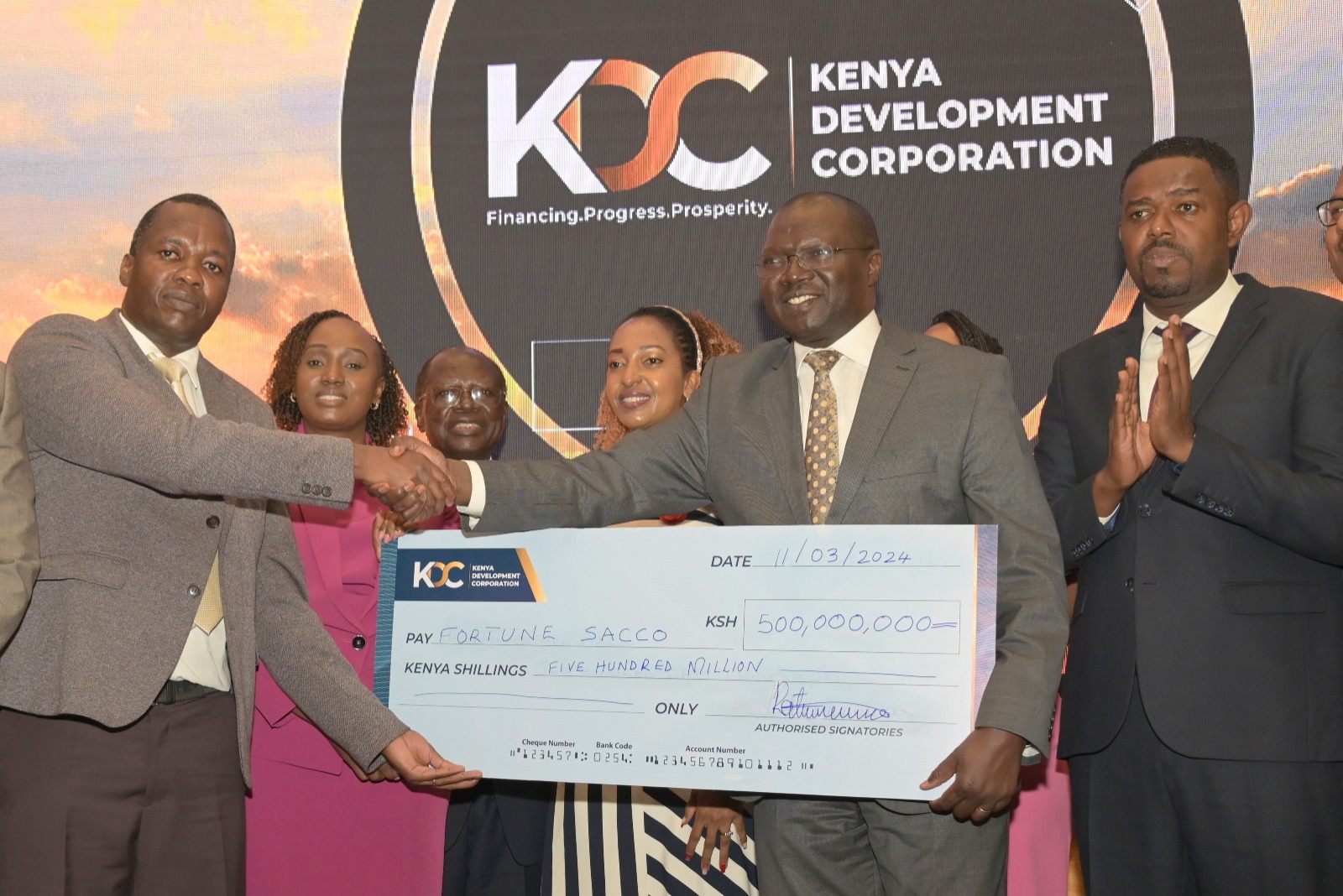

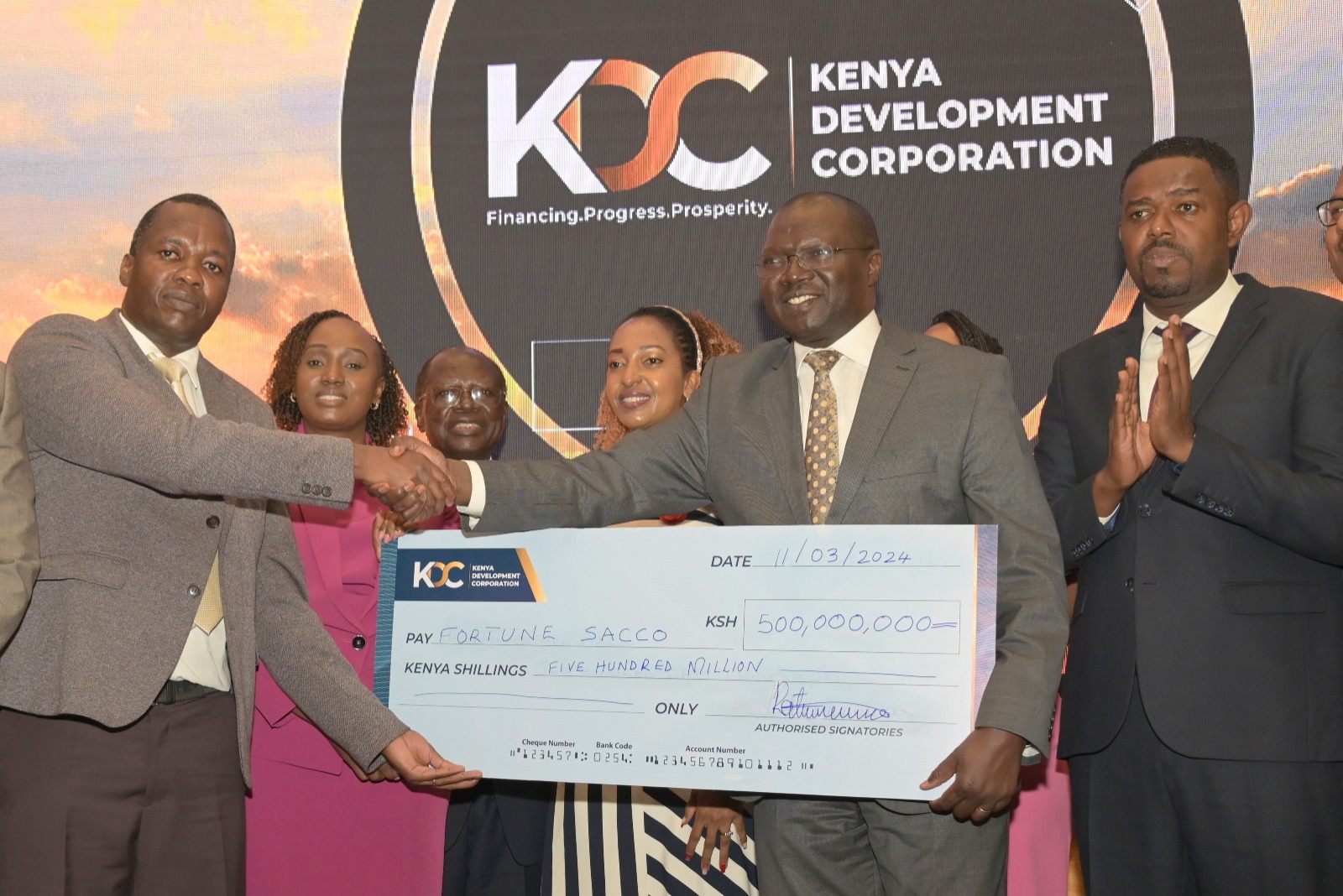

As a Rapid Response Initiative, the Government of Kenya (GoK) mobilized resources of up to Kshs 3 Billion through the establishment of a Credit Guarantee Scheme (CGS) under the National Treasury. Thereafter, the World Bank through the International Development Association (IDA) loaned the GoK US $100M to support the MSMEs.

The Project aims to increase access to credit for MSMEs, enhance their capabilities and support their recovery from the COVID-19 shocks. The SAFER project became effective on 9th May 2022.